Credit ScorecardBuild trust, manage risks, and make explainable decisions – transparent, compliant, and fully auditable.

Explainable Credit Decisions – Fast, Secure, Scalable.

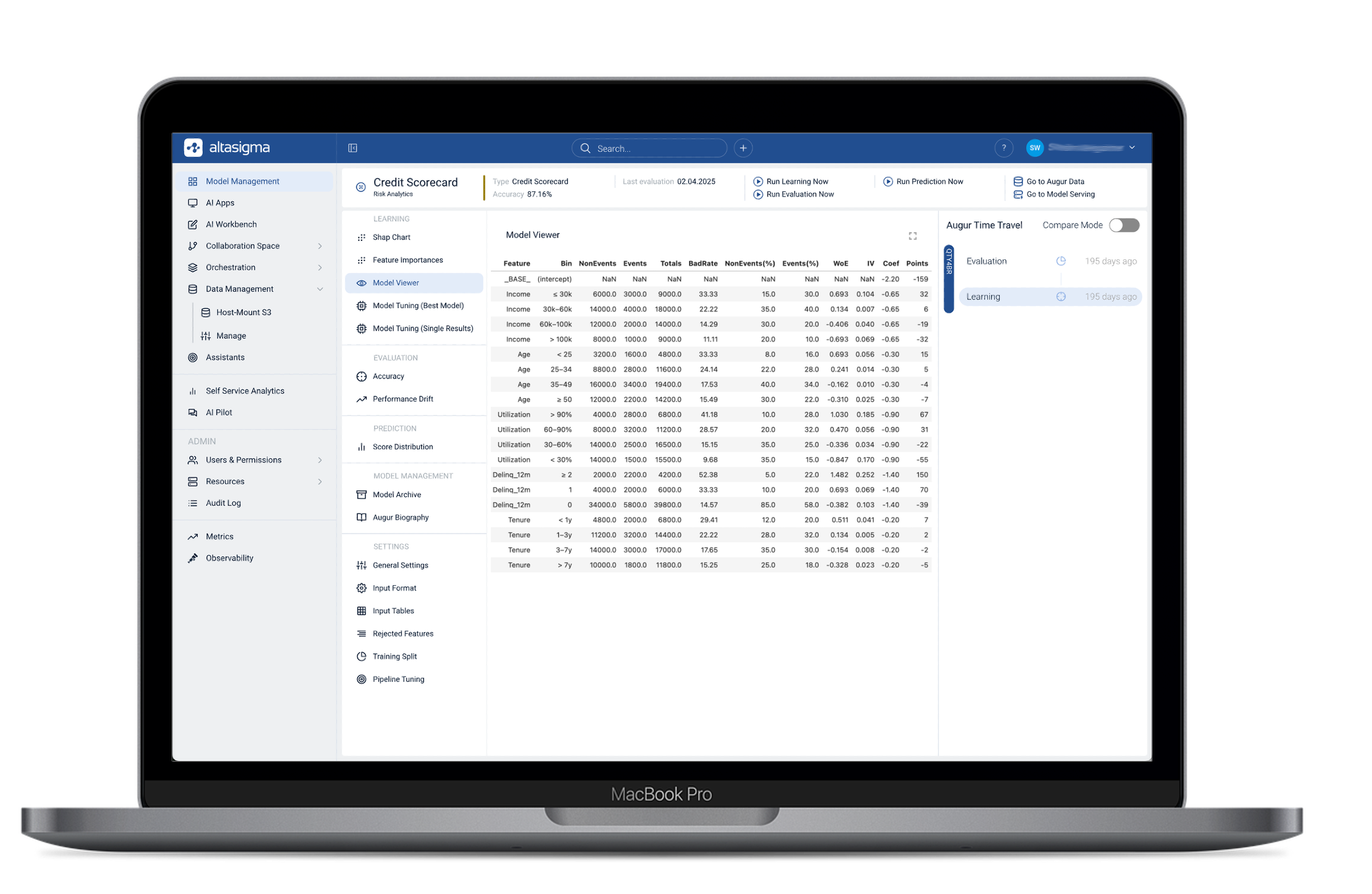

Our AI-powered Credit Scorecard automates and optimizes your risk assessments – fully compliant, transparent, and ready for immediate deployment. Every score is backed by clear reasoning, and every process is fully auditable.

Features

Automated Scorecard Generation: Instantly create ready-to-deploy credit scorecards with fully transparent scoring logic.

AI-Powered Binning Optimization: Dynamic, data-driven binning using advanced AI algorithms – no manual tuning required.

Smart Feature Engineering: Automatically derive Weight of Evidence (WoE), Information Value, and more – optimized for both accuracy and interpretability.

Built-in Explainability & Reason Codes: Each score includes clear, traceable reasons – with optional narrative output for better communication.

Model Lifecycle & Governance Tools: Full control with model versioning, retraining capabilities, and audit logs – designed for regulatory compliance.

Real-Time Evaluation & Visual Analytics: Integrated performance metrics and charts like ROC, Lift, KS, and CAP – ready at your fingertips.

Our solutions harness enterprise-grade AI capabilities that truly make a difference

AI Model ManagementAI Models – Custom-Trained. Automatically Optimized. Always Up-to-Date.

Integrated Data LakehousePlug & Play for Your Data – Compatible. Flexible. Fully Integrated.

REST APIAI-as-a-Service – Open. Extensible. Ready to Connect.

Compliance by DesignLegally Compliant. Transparent. 100% Aligned with the EU AI Act.

Credit Scorecard – Key Benefits at a Glance

0%

reliable & compliant

-0%

less manual effort

+0%

faster credit decisions

Unique Selling Points

01

100% GDPR CompliantFully supports disclosure obligations under Art. 22 GDPR & EBA guidelines — auditable and fully documented.

02

Complete Transparency & ExplainabilityEvery decision is fully traceable, with both technical and domain-level explanations.

03

Flexible Target ModelingBeyond default risk probabilities, customize numerical target variables for more precise risk and value forecasts.

04

Superior Binning & Feature SetDelivers significantly better performance and interpretability compared to competing solutions.

05

Modular & IntegratableSeamlessly combines with our Fraud Detection and Risk Monitoring solutions on a unified AI platform.

06

Deployment-Ready in DaysFrom raw data to production-ready scoring models in a fraction of the usual time.

Explore more AI solutions for holistic Risk Management

Risk Guardian

The Risk Guardian uses AI and LLMs on public data to continuously monitor existing customers and assess the risks of new customers early – enabling smarter decision-making.

Physical Risk Profiler

Stay ahead with our AI-powered Physical Risk Profiler – accurately assess building risks, anticipate challenges, and gain a decisive advantage.

Fraud Detection

Our smart AI-powered Fraud Detection solution uncovers fraud risks early – ensuring secure processes and long-term business success.Curious to learn more?

Experience AI-powered Credit Scoring that ensures compliance and delivers results. Schedule your demo now and discover how to manage credit risk more intelligently.